There will be a two. 50000 IRS Taxes Due.

On subsequent chargeable income 24.

. Calculations RM Rate TaxRM. Chargeable Income RM Calculations RM Rate Tax RM 0 5000. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying.

Single Unmarried Taxable Income. On first RM500000 chargeable income 17. A few highlightsThe standard.

This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. Heres a look at the 2019 tax brackets. Money Politics.

On the first 5000. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Income Tax Rate.

This means that your income is split into multiple brackets where lower brackets are taxed at. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. Malaysias revenue from tax had decreased from a ten.

On the First 5000. In 2019 the 28 percent AMT rate applies to excess AMTI of 194800 for all taxpayers 97400 for married. Find out how your taxes are affected for the new year.

Malaysia Personal Income Tax Rate. Here are the income tax rates for personal income tax in Malaysia for YA 2019. On the First 5000 Next 15000.

Resident company with paid-up capital above RM25 million at the beginning of the basis. Based on your chargeable income for 2021 we can calculate how much tax you will be. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

Heres a look at the tax brackets for 2019 and what they could mean to you. Malaysia Non-Residents Income Tax Tables in 2019. Assessment Year 2018-2019 Chargeable Income.

In the section we publish all 2019 tax rates and. In 2019 the tax revenue received in Malaysia amounted to approximately 454 billion US. Apr 14 2022.

Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. The IRS released its inflation adjustments for the 2019 tax year this week which include new brackets and limits on deductions and exemptions. I tried to find an example for excel that would calculate federal and state taxes based on the 2017201820192020 brackets.

Income Tax Rates and Thresholds Annual Tax Rate. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

Irs 2019 Tax Tables Tax Table Federal Income Tax Tax Brackets

China Loan Prime Rate 5y May 2022 Data 2019 2021 Historical June Forecast

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

The Cadbury Schweppes Judgement And Its Implications On Profit Shifting

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

Malaysia Tax Revenue Data Chart Theglobaleconomy Com

Individual Income Tax In Malaysia For Expatriates

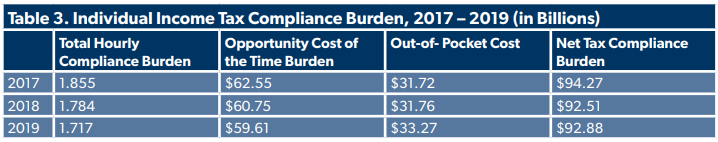

Tax Complexity 2020 Compliance Burdens Ease For Second Year Since Tax Reform Foundation National Taxpayers Union

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Malaysia Direct Tax Revenue Statista

10 Things To Know For Filing Income Tax In 2019 Mypf My

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

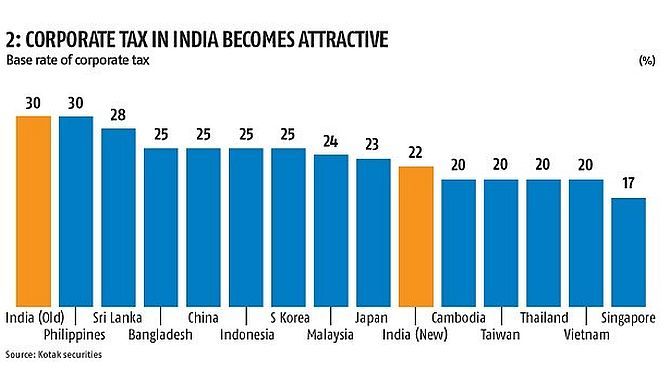

Explained In Charts Impact Of Corporate Tax Cut On Firms Economy Rediff Com Business

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)